The Bitcoin price can hit a new all-time high (ATH) this Uptober, considering that this month is historically one of its best months. This historical trend indicates that the flagship crypto could rise to as high as $80,000 as it surges past its current ATH of $73,000. However, the path to a new ATH might not be as easy as expected.

Bitcoin Price To Rally To New ATH This Month

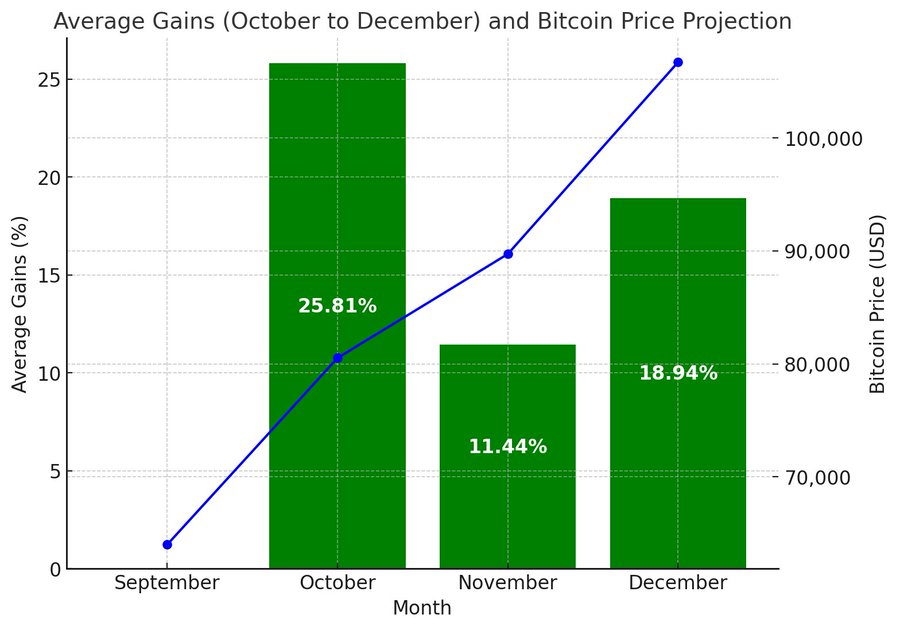

The BTC price is set to rally to a new ATH this month, with historical trends pointing to this happening. The flagship crypto closed in September with a price gain of 7%. This is notable because Coinglass data shows that Bitcoin has recorded positive monthly returns in the last three months of the year, the three times this has happened.

Furthermore, the prominent Bitcoin X platform BTC Archive shared data that showed that the flagship crypto could rise to as high as $80,000 following its green September. The crypto has enjoyed an average gain of 25.81% in October after a green September candle. Based on this, BTC could reach $80,500 if it replicates this average gain.

Meanwhile, trading firm QCP Capital noted that the Bitcoin price has enjoyed an average gain of 22.9% in 8 out of the last 9 October. A similar price gain would send BTC above $78,000, well above its current ATH of $73,000. The trading firm also cited other factors that support the crypto reaching a new ATH.

QCP Capital mentioned that the Spot Bitcoin ETFs inflows remain consistently positive while perp funding is approaching levels that were recorded during the bull run in the first quarter of this year. The significant inflows these Bitcoin ETFs recorded in Q1 contributed to the BTC price reaching its current ATH of $73,000 in March.

10x Research founder Markus Thielen also predicted that BTC will soon reclaim $70,000 and reach a new ATH by late October. The analyst cited the rising stablecoin liquidity and China’s monetary easing policies as factors that could spark this price rally above $73,000.

The Road To A New ATH Won’t Be Straightforward

Although the Bitcoin price will likely reach a new ATH this month, the rally above $73,000 won’t be straightforward. According to a CoinGape analysis, BTC will likely correct following the drop below the crucial support level of $65,000. The analysis further predicted that the flagship crypto could revisit $61,000 due to this price correction.

This has already happened partly thanks to the escalating conflict between Israel and Iran. The Bitcoin price is fast approaching the psychological price level of $60,000. However, crypto analyst Ali Martinez stated this was just a “little shake out before the breakout.” The analyst had previously outlined a scenario whereby the flagship crypto drops to as low as $57,000 before it breaks out towards $78,000.

The on-chain analytics platform Santiment had also suggested that any price retrace would be bullish for the Bitcoin price and the broader crypto market. The platform stated that the crowd’s current bullish sentiment toward BTC indicated a high top probability for the market. This bullish sentiment could change as the Isreal Iran conflict is already sparking a wave of sell-offs. Santiment predicts that the bull market will begin shortly once FOMO turns to FUD.

The Israel Iran tension is currently affecting the crypto market rally and putting downward pressure on prices. However, the market could easily reverse once tensions in the Middle East cooled off. It is worth mentioning that September began on a similar note as the Bitcoin price suffered a 10% crash in the first week before kickstarting its 26% rally to $65,000.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Leave a Reply