The Bitcoin price rally has noted a pause today, with investors shifting focus towards the upcoming US CPI inflation data. Besides, it also reflects the expectations of the market experts, who anticipate a slight pullback ahead for BTC before further run in the coming days. However, despite that Peter Brandt indicates a bullish run for BTC ahead, sparking optimism in the market.

Bitcoin Price To Hit $327K, Peter Brand Predicts

In a recent X post, veteran trader Peter Brand shared a bullish outlook on Bitcoin price, suggesting that the crypto could hit new highs in the coming days. Notably, Brandt posted a chart, showing two possible price paths for BTC, which are $134K and $327K. Sharing the chart, he has shared two potential scenarios that might decide where the flagship crypto is heading next.

For context, he said some believe that Bitcoin is overbought, and in that case, it could hit $134K next. However, he also noted that many in the crypto community believe that BTC price has just started its bull run, which might set its next target at $327K.

Notably, his analysis has captured both bullish and bearish possibilities, with the high target of $327K has caught the investors’ eyes. Besides, the chart’s dual-range possibilities indicate that BTC could experience significant volatility in its path ahead, but a breakout could push it beyond its recent ATHs.

Although the lower target of $134K appears more feasible, the flagship crypto could also target the higher range outlook in the long run. Notably, the expected clear regulatory path in the US for crypto and a pro-crypto regulatory body under Donald Trump might help the recent crypto market rally to continue.

Besides, Brandt has also recently predicted BTC to hit $200K. This prediction also aligned with Bernstein analysts’ outlook, who have also predicted a similar surge for the crypto in the coming days.

Will BTC Face Challenge Ahead?

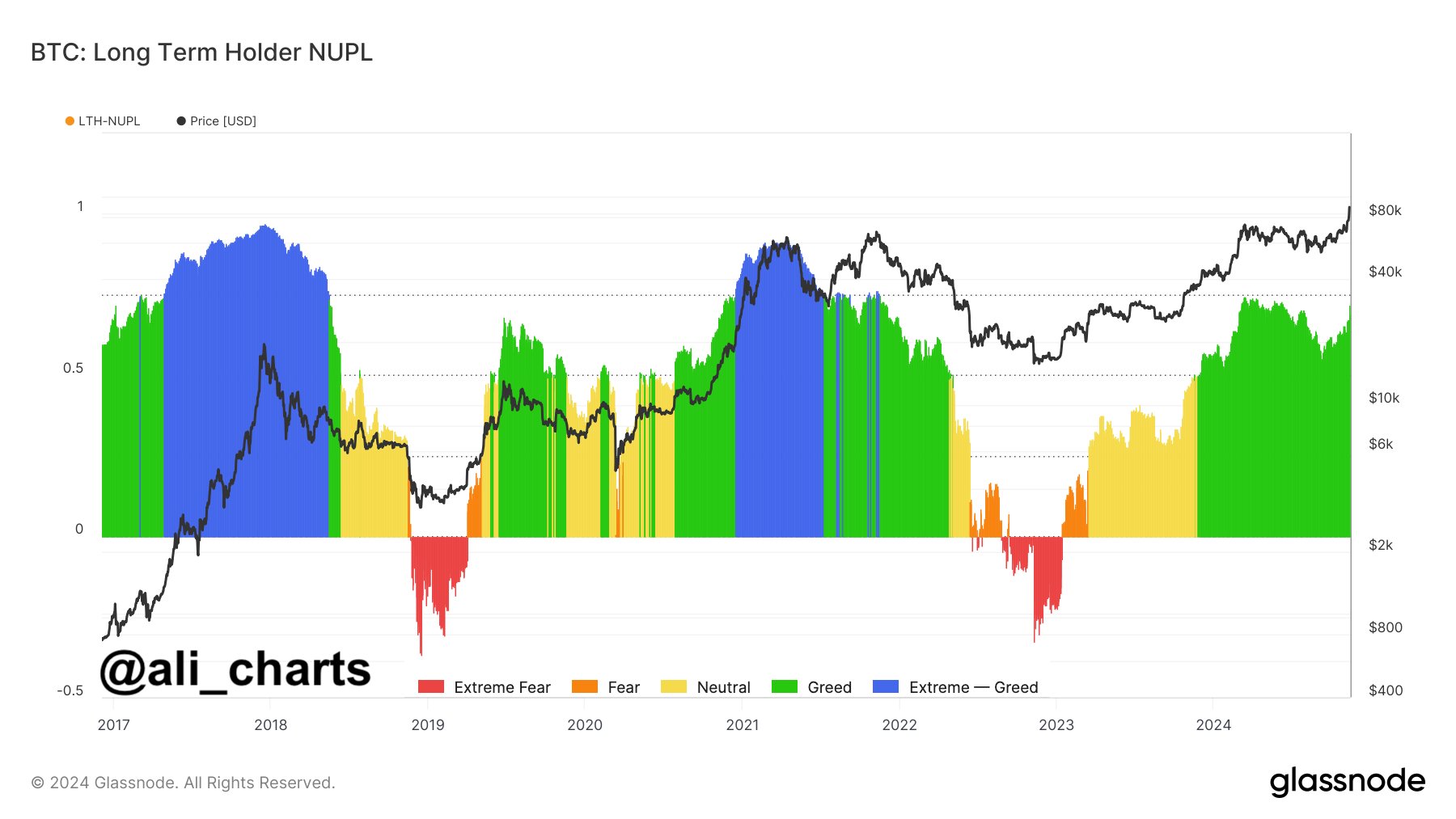

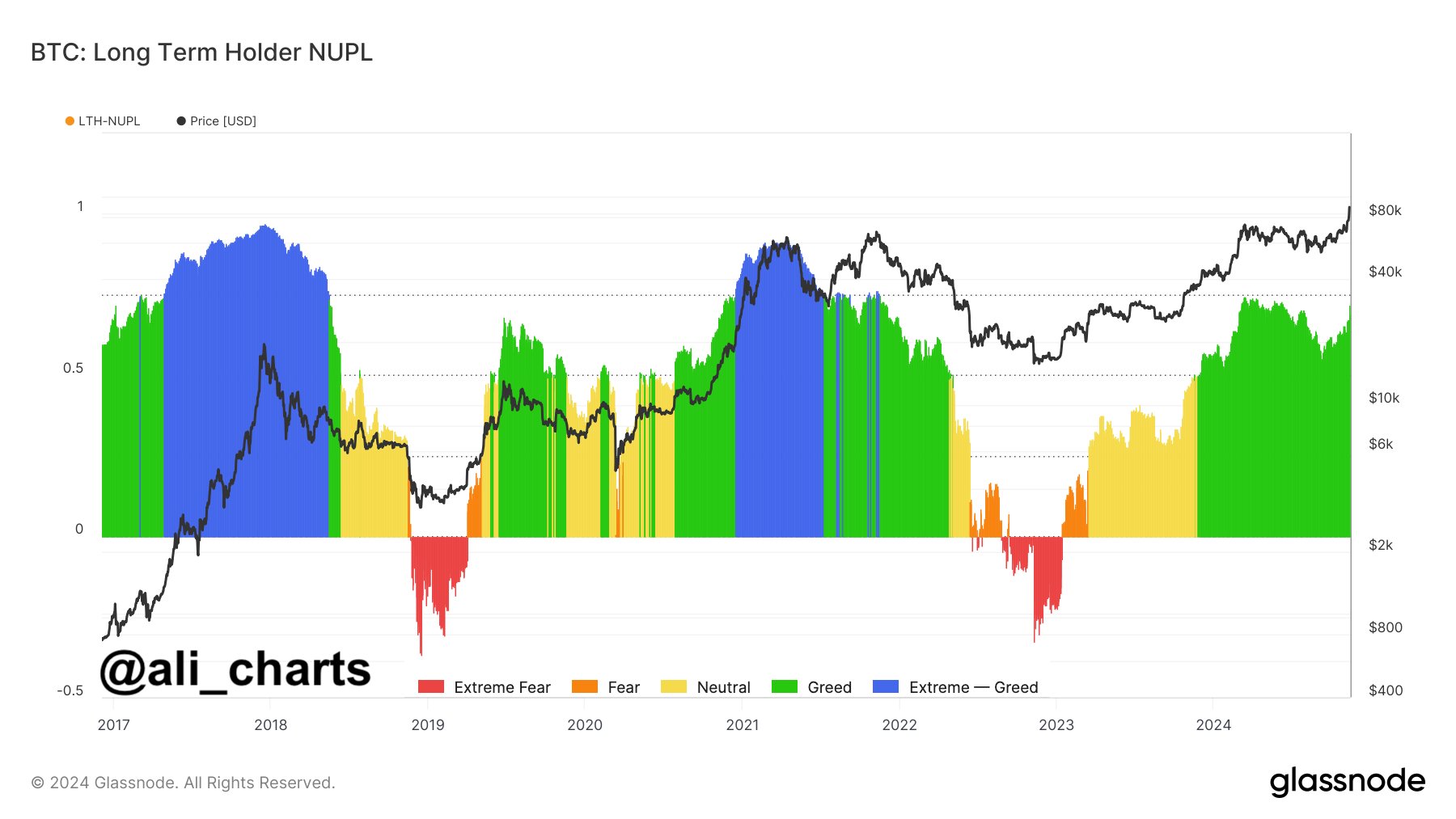

While Peter Brandt remains optimistic about Bitcoin price, other market analysts appear to have remained cautious over short-term volatility due to US CPI and other macroeconomic factors. A prominent crypto analyst Ali Martinez recently shared his observations on X, noting that long-term Bitcoin holders are still not showing signs of “extreme greed” despite Bitcoin’s recent price increases.

This restraint among holders indicates a level of confidence and stability, as long-term holders typically signal overall market sentiment and future price sustainability. Martinez’s comment aligns with Brandt’s view of a potential rally, though he hints at a gradual buildup in momentum rather than an immediate surge.

However, the near-term outlook is clouded by upcoming US CPI inflation data, which could impact investor sentiment across the financial markets. Many experts anticipate a brief pullback in BTC prices as traders digest economic updates and prepare ahead of time for possible interest rate cuts by the Federal Reserve.

Meanwhile, BTC price today was down over 2% and exchanged hands at $87,540, while its trading volume fell 14% to $119 billion. However, the crypto has touched a 24-hour high of $89,915.57, after touching an ATH of $89,956 this week. Further BTC Futures Open Interest also fell nearly 3% in the last 24-hour time-frame, indicating that the investors are staying in the sideline ahead of the crucial economic data.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Leave a Reply