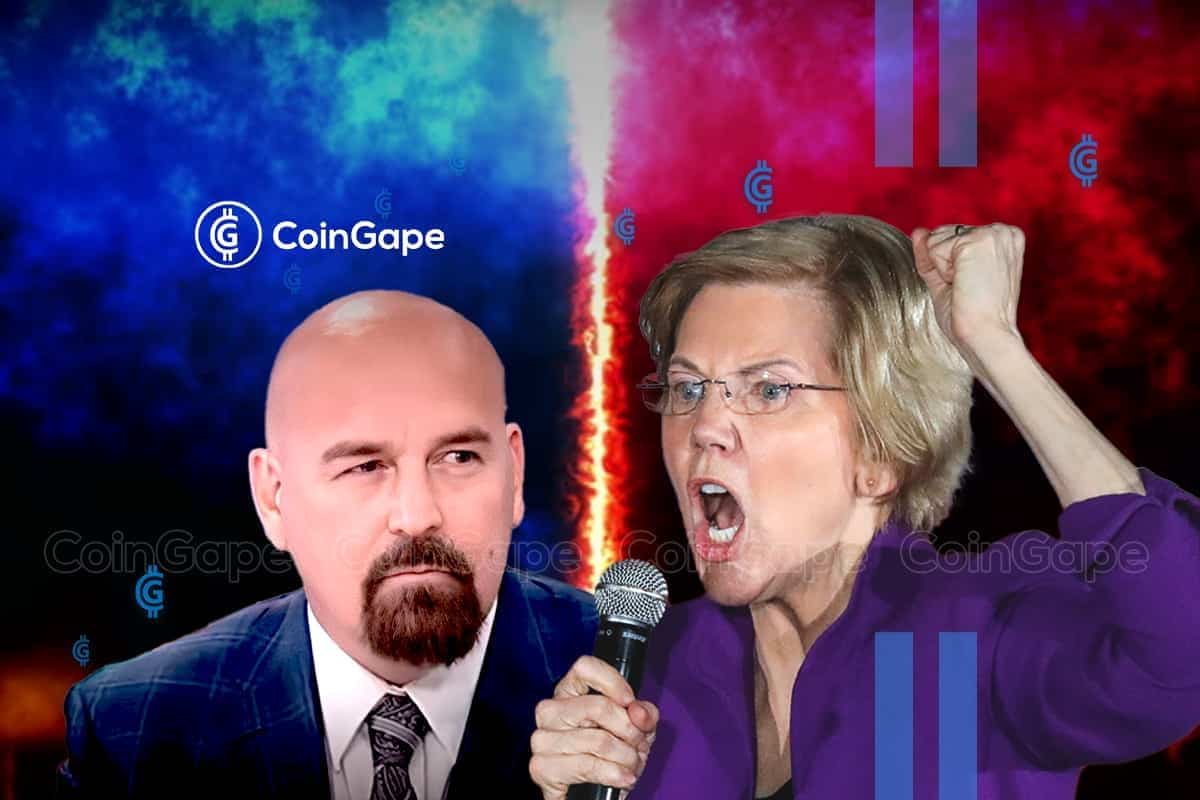

John Deaton, a pro-XRP lawyer, criticized Senator Elizabeth Warren’s comments attributing rising prices to corporate greed. Deaton argued that the true cause of inflation is government actions, specifically the printing of money by central banks.

He emphasized that such inflationary policies have historically led to the devaluation of the US dollar and contributed to the country’s current economic challenges.

John Deaton Challenges Sen. Warren’s Take, Blames Government For Inflation

Replying to Senator Warren’s tweet on X, Deaton highlighted that since the establishment of the Federal Reserve in 1913, the US dollar has devalued by 98%. He pointed out that a significant amount of US currency was printed in the last four years, correlating with the highest inflation rates seen in four decades.

Additionally, the pro-XRP lawyer referenced former Treasury Secretary Larry Summers, who had predicted severe inflation if monetary expansion continued under current policies. More so, John Deaton accused Senator Warren of supporting such policies and expressed a strong desire to debate these topics publicly.

The pro-XRP lawyer added,

“If Senator Warren would’ve accepted my single issue debate challenge, which included inflation, we would’ve debated the issue of inflation for one hour.”

However, Senator Warren has consistently framed the issue of rising prices as a result of corporate greed. She advocates for stricter regulations on major corporations to curb price increases at essential places like grocery stores and gas stations. Warren’s approach targets a crackdown on what she perceives as exploitative pricing practices that harm consumers and exacerbate economic inequality.

Meanwhile, John Deaton’s critique extends to Warren’s overall economic policies, which he views as misguided and harmful to economic stability. This sentiment is part of a broader discourse on the role of government in regulating emerging technologies and financial systems.

Similarly, the crypto industry has expressed frustration with Senator Warren’s adversarial approach to crypto regulations. Most recently, Coinbase CEO Brian Armstrong said,

“Crypto holders in MA should realize Senator Warren is the one who got Gary Gensler his job and encouraged him to (unlawfully) try and kill the crypto industry in America.”

Moreover, the Coinbase co-founder asked Massachusetts residents to support John Deaton, emphasizing his stance as a pro-crypto advocate

Predictions of Inflation-Driven Bitcoin Surge

Amidst these economic discussions, Arthur Hayes, co-founder of BitMEX, has made predictions regarding Bitcoin’s potential surge due to inflationary policies. Hayes argues that geopolitical tensions and the consequent monetary expansion by the US government could weaken the US dollar and enhance Bitcoin’s appeal as a “digital gold.”

Hayes suggests that increased military spending and monetary policies that expand the Federal Reserve’s balance sheet will lead to inflation ahead of US elections. This would make Bitcoin an attractive hedge against depreciating fiat currencies. He believes that this scenario will boost demand for Bitcoin as investors seek stability in alternative assets.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Leave a Reply