Pumpfun, a platform for Solana-based memecoins, has sold 36,400 SOL tokens worth approximately $6.77 million in its latest transaction. This move comes as the Solana (SOL) token has seen a 10% price increase over the past 24 hours.

The surge in SOL’s price follows renewed optimism around the possibility of an exchange-traded fund (ETF) approval under the incoming administration in the United States.

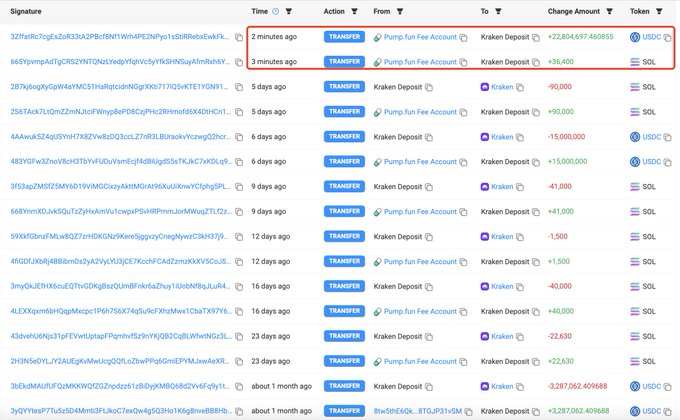

Pumpfun Sells Another $6.77M SOL Holdings

In addition to the recent SOL sale, Pumpfun has transferred the remaining $22.8 million in USD Coin (USDC) from its holdings to Kraken, one of the world’s largest cryptocurrency exchanges.

This follows an earlier deposit of 90,000 SOL, valued at about $14.97 million, into Kraken. By channeling assets to a high-liquidity exchange, Pumpfun aims to ensure smoother trading conditions for its users. These steps align with the platform’s broader goal of enhancing liquidity for its memecoin offerings on major exchanges.

By moving assets to Kraken, Pumpfun is positioning itself to support more flexible and accessible trading options, which could be advantageous for its user base amid the recent market rally in Solana.

Cumulative SOL Sales Reach $108 Million

Since its inception, Pumpfun has generated considerable revenue from SOL sales. To date, the platform has sold 672,243 SOL tokens, amounting to $108 million, at an average price of $160.5 per token.

This total forms part of the 1.14 million SOL ($212 million) in revenue that Pumpfun has generated, underscoring its substantial impact on Solana’s market liquidity. The latest sale, alongside the previous deposit on Kraken, suggests Pumpfun is actively managing its SOL holdings to maintain liquidity and meet the rising demand in the market.

This ongoing pattern of strategic sales and deposits highlights Pumpfun’s cautious approach to sustaining trading momentum on its platform, especially as market conditions shift. By leveraging Kraken, Pumpfun ensures that its assets remain readily tradable, accommodating users amid heightened market interest in Solana.

Solana’s Price Surge Linked to ETF Speculation

SOL’s recent 10% price increase is largely driven by speculation about a possible ETF approval under the Trump administration. Following Trump’s recent election victory over Kamala Harris, investors are growing optimistic that regulatory bodies could greenlight a spot Solana ETF in early 2025.

Prominent analysts, including Erick Balchunas from Bloomberg, have raised the probability of a SOL ETF approval, noting a 20% chance post-election.

Daniel Cheung, co-founder of Syncracy Capital, stated in a post on X that the market might be “mispricing” the potential impact of a Republican-led administration on cryptocurrency regulations. He noted that an ETF approval for Solana could lead to the token reaching significant price levels, with some analysts speculating that SOL could eventually challenge Ethereum’s position in the market.

Following the recent price surge, SOL is currently trading around $185.29. The token recently overcame resistance at $171.73, and analysts are now watching a critical resistance level at $188.36. If SOL can break above this threshold, further price gains may be possible. However, if SOL faces rejection at this level, the token could pull back to support zones around $171 or even $160.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Leave a Reply